As with many major technology changes there has been a huge amount of talk about the impact of the new PSD2 regulations and particularly those relating to the availability of APIs and the impact these will have on customer behaviour going forward. This long-awaited development is now getting closer with the requirement for all banks (but not Credit Unions, Municipal Banks or the National Savings Bank) operating 'payment accounts' to provide API access for Third Party Payment Providers (TPPs) to originate payments or provide account information. This requirement comes into play on the 14th September 2019, but banks impacted must select suppliers, build the necessary interfaces and test their solutions.

Less talked about in the press are the changing requirements for payment authorisation which in many payment industry minds will have a much bigger effect on banks, retailers and customers than the introduction of APIs due to the potential friction at Point-of-Sale.

Fairmort is focussing on two key areas. The first is the use of Fast-Fuse as an interface between API hosting providers and the back-end core banking systems. Fast-Fuse has already been successfully interfaced to multiple core banking systems and can also talk to our WILF Reporting (WILFr) Data Warehouse for access to additional data not stored in the core banking system or as a method of avoiding stressing the live core banking system from external data requests.

The second is the use of WILFr as a data repository for those banks wishing to extend their services to offer their clients the ability to collect data from other financial institutions to provide the client with a single view of their financial situation. This is of particular interest to banks that are not planning to offer 'payment accounts' going forward but wish to maintain their client relationships.

Fairmort has a number of customers looking at suppliers for API access and we are trying to see if there is any sense in several banks trying to work with the same vendor. Fairmort is looking to deal with the integration requirements as we have several systems out of the box (T24, Flexcube, BM+, Equation) via Fast-Fuse. Our feeling is that if there is some common use of the same vendor and interface method (probably ISO 20022) there is likely to be some cost savings for the overall solution.

At Fairmort we value our customers and work hard to both deliver software solutions which meet your key business requirements and build strong relationships based on trust.

We recognise that we have a responsibility to help you ensure the long-term performance and availability of your Fairmort applications, including WILFr and Fast-Fuse, and ultimately to assure your business continuity.

Fairmort works in partnership with NCC Group to provide business continuity assurance and protection.

To ensure our software is compliant with the latest regulations we proactively research regulatory changes monthly. These changes may have an impact on your business.

The MREL Policy and Supervisory Statement has been published. This also includes reporting templates and guidance for V3.1 of the XBRL Taxonomy for MREL reporting, which will take effect from Tuesday 1st January 2019.

Updated guidelines and protocols have been published for the forthcoming PRA110 return, which will replace returns FSA047 and FSA048, and is scheduled for general introduction by July 2019. The most recent announcements include:

- Announcement about an interim reporting period alongside FSA047 and FSA048

- First introduction scheduled for November 2018, to be submitted alongside FSA047 and FSA048 returns

- Submitted to Gabriel via xbrl format

- Some institutions have been requested to take part in testing and trials

A note and graphic have been published describing the transition to v2.7 and v2.8 of the EBA's FINREP Taxonomy.

We have received feedback directly from the PRA to clarify our questions about some finer points of detail. We share these clarifications with you here:

The WILFr GDPR module provides tools for managing the classification of your data in one place, which can be particularly problematic if you hold personal data in multiple systems, performing data security audits, responding to Requests-for-Information, and the Right-To-Be-Forgotten. If you would like to find out how the WILFr GDPR module can help your business, contact Clive Bowles - clive.bowles@fairmort.com

Since the GDPR legislation came into place in May 2018, the Information Commissioners Office (ICO) has continued to update its guidelines on a monthly basis. You can find all the latest updates at:

https://ico.org.uk/for-organisations/guide-to-the-general-data-protection-regulation-gdpr/whats-new/

| Date | Topic | Ref | Other Ref | Report | Comment | Link to webpage | |

|---|---|---|---|---|---|---|---|

| 15 August 2018 | FCA | BCOBS 7 requires a firm to publish information about its provision of personal current accounts and business current accounts. | BCOBS 7 effective | Information about current account services must be published to a pre-defined format at given periods. | Click Here | ||

| 27 July 2018 | PRA | Credit risk: the definition of default | CP 17/18 Closes 29/10/18 |

"In this Consultation Paper (CP), the Prudential Regulation Authority (PRA) sets out its proposed approach to implementing the European Banking Authority's (EBA's) recent regulatory products relating to the definition of default in the Capital Requirements Regulation (575/2013) (CRR). The EBA has developed a roadmap of regulatory products ('EBA roadmap') with the aim of reducing unwarranted variability in the risk weighted assets (RWAs) calculated using banks' Internal Ratings Based (IRB) models. Two of the products from the EBA roadmap relate to the definition of default: the Regulatory Technical Standards ('the RTS') for the materiality threshold for credit obligations past due and the Guidelines on the application of the definition of default ('the GL'). This CP sets out the PRA's proposed approach to implementing these three products. The proposals are relevant to UK banks, building societies and PRA-designated UK investment firms. " | Click Here | ||

| 23 July 2018 | PRA | In this Consultation Paper (CP), the Prudential Regulation Authority (PRA) sets out proposals for minor regulatory reporting amendments. | CP 16/18 Closes 23/10/18 |

This consultation is relevant to banks, building societies, PRA-designated investment firms, and dormant account fund operator(s). The proposals would result in changes to the Glossary, Regulatory Reporting, Reporting Pillar 2, and Close Links Parts of the PRA Rulebook (Appendix 1). It also proposes amendments to reporting templates and instructions. To assist the reader, a mapping table is included in Appendix 2, with the proposed amendments to templates and instructions contained in Supervisory Statement (SS) 32/15 'Pillar 2 reporting, including instructions for completing data items FSA071 to FSA082' (Appendix 3), and in SS34/15 'Guidelines for completing regulatory reports' (Appendix 4). | Click Here | ||

| 19 July 2018 | EBA | EBA publishes final guidance to strengthen the Pillar 2 framework | EBA-GL-2018/02 & 03 & 04 | The European Banking Authority (EBA), in accordance with its Pillar 2 Roadmap, published today its final revised Guidelines aimed at further enhancing institutions' risk management and supervisory convergence in the supervisory review and examination process (SREP). The three reviewed Guidelines focus on stress testing, particularly its use in setting Pillar 2 capital guidance (P2G), as well as interest rate risk in the banking book (IRRBB). | Click Here | ||

| 10 July 2018 | EBA | EBA publishes final guidance to strengthen the Pillar 2 framework | The European Banking Authority (EBA), in accordance with its Pillar 2 Roadmap, published today its final revised Guidelines aimed at further enhancing institutions' risk management and supervisory convergence in the supervisory review and examination process (SREP). The three reviewed Guidelines focus on stress testing, particularly its use in setting Pillar 2 capital guidance (P2G), as well as interest rate risk in the banking book (IRRBB). | Click Here | |||

| 5 July 2018 | PRA | Building the UK financial sector's operational resilience | DP 01/18 | The Bank of England, Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) have published a joint discussion paper (DP) on an approach to improve the operational resilience of firms and financial market infrastructures (FMIs). | Click Here | ||

| 5 July 2018 | BOE | Published v3.1.0 of the Bank of England Banking XBRL taxonomy, alongside related technical artefacts. This taxonomy is to be used for MREL reporting which follows Policy Statement 11/18 'Resolution planning: MREL reporting', published on 13 June 2018. This will take effect from Tuesday 1 January 2019. | XBRL | This taxonomy is to be used for MREL reporting which follows Policy Statement 11/18 'Resolution planning: MREL reporting', published on 13 June 2018. This will take effect from Tuesday 1 January 2019. | |||

| 4 July 2018 | PRA | Whistleblowing in deposit-takers, PRA-designated investment firms and insurers | SS 39/15 (updated) | This supervisory statement applies to the relevant firms (deposit-takers with assets greater than £250 million, PRA-designated investment firms and insurers - meaning insurance and reinsurance firms within the scope of Solvency II - and to the Society of Lloyd's and managing agents), but also to individuals working in the financial services sector. It will also be of interest to a wider range of firms that may wish to comply voluntarily. This statement sets out the expectations of the PRA on how firms should comply with the PRA's rules on whistleblowing. | Click Here | ||

| 4 July 2018 | PRA | Conditions, time limits and variations | Statement of policy updated | PS 15/18 | "This statement of policy is issued by the Prudential Regulation Authority (PRA) in accordance with section 63ZD of the Financial Services and Markets Act 2000 (FSMA) as amended by the Financial Services (Banking Reform) Act 2013, which requires the PRA and the Financial Conduct Authority (FCA) to issue a statement of their respective policies on: approving individuals under section 59 of FSMA subject to conditions and time limits; and varying approvals under section 59 of FSMA." | Click Here | |

| 4 July 2018 | PRA | Corporate governance: Board responsibilities | SS 5/16 (updated) | The purpose of this supervisory statement is to identify, for the boards of firms regulated by the Prudential Regulation Authority (PRA), those aspects of governance to which the PRA attaches particular importance and to which the PRA may devote particular attention in the course of its supervision. It is not intended to provide a comprehensive guide for boards of what constitutes good or effective governance. There are more general guidelines for that purpose, for example the UK Corporate Governance Code, published by the Financial Reporting Council. | Click Here | ||

| 4 July 2018 | PRA | Strengthening individual accountability in banking | SS 28/15 (updated) | This supervisory statement sets out the Prudential Regulation Authority's (PRA's) approach to strengthening individual accountability in banking. It applies to all Relevant Authorised Persons (Relevant Firms) as defined in section 71A of the Financial Services and Markets Act 2000 (FSMA) namely: | Click Here | ||

| 3 July 2018 | PRA | UK leverage ratio: Applying the framework to systemic ring-fenced bodies and reflecting the systemic risk buffer | CP 14/18 | In this consultation paper (CP) the Prudential Regulation Authority (PRA) proposes to apply the systemic risk buffer (SRB) framework in the UK leverage ratio framework. | Click Here | ||

| 28 June 2018 | PRA | Changes to the PRA's large exposures framework | PS 14/18 | CP 20/17 | LE | This PS is relevant to PRA-authorised UK banks, building societies, PRA-designated UK investment firms and their qualifying parent undertakings, which for this purpose comprise financial holding companies and mixed financial holding companies, as well as credit institutions, investment firms and financial institutions that are subsidiaries of these firms, regardless of their location. | Click Here |

| 13 June 2018 | PRA | Resolution planning - MREL Reporting | MREL | PS 11/18 | MREL | New policy statement issued. Update to Supervisory statement SS 19/13 Resolution Planning. Effective 01/01/2019 | Click Here |

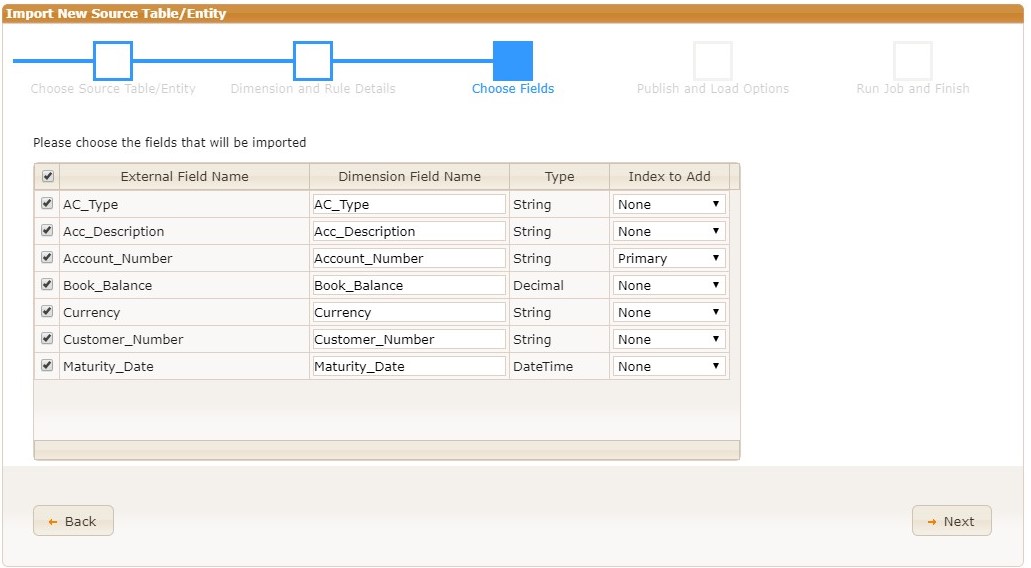

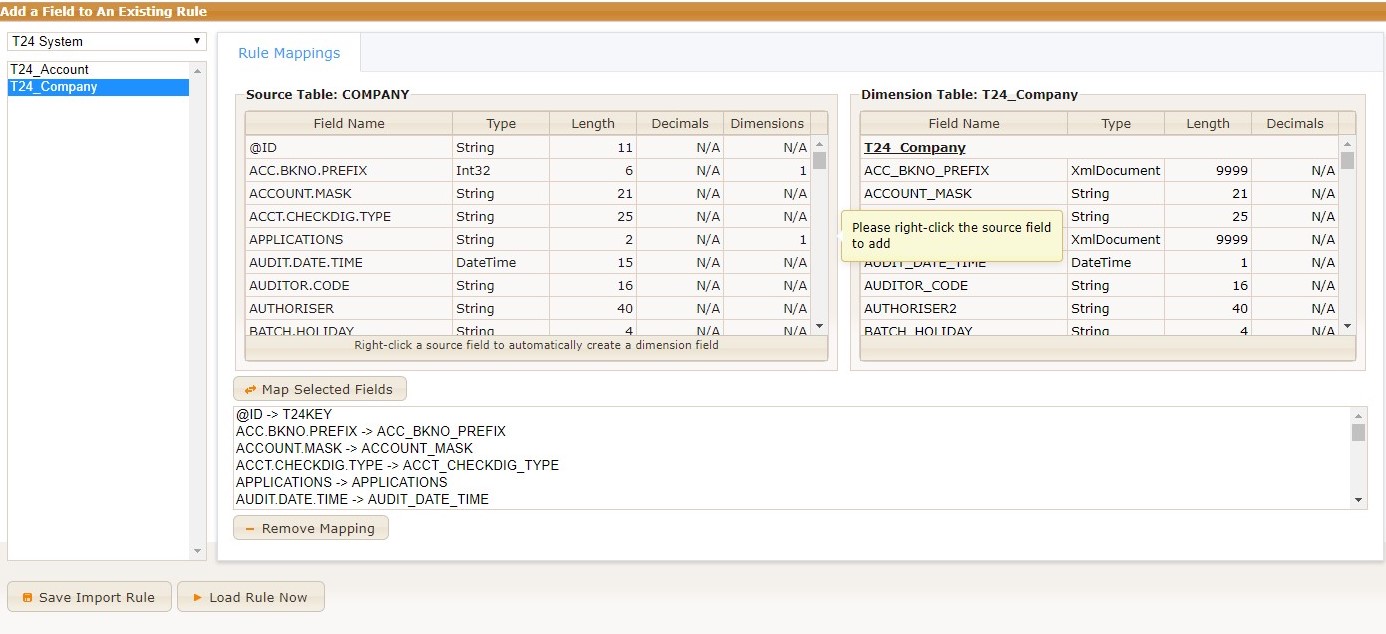

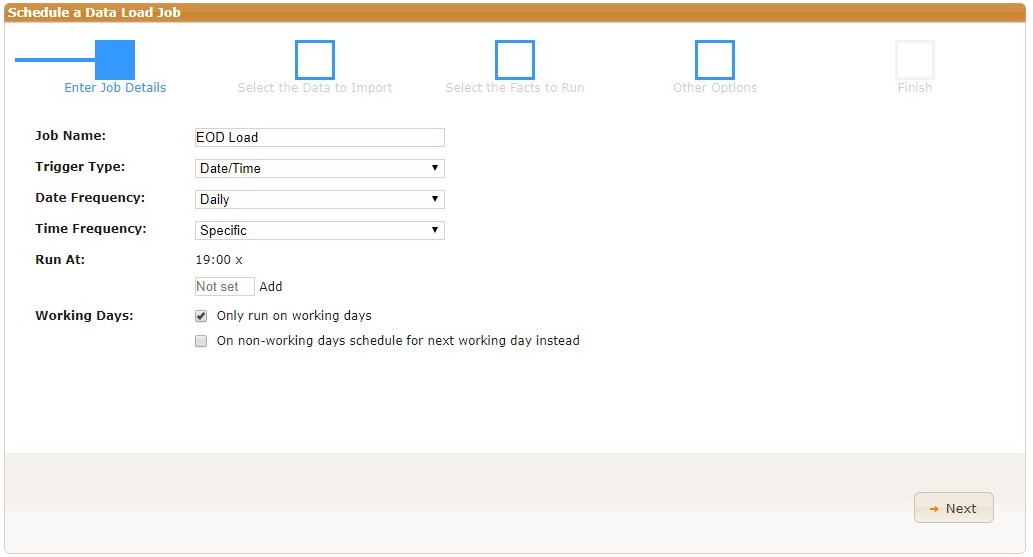

WILFr v2.1 introduces database configuration and data extraction functionality into the browser user interface for better user access. Wizards have been introduced for the more commonly used functions to simplify processes and improve the user experience. From these improvements, WILFr users will have better control of their data, where adding new tables or fields can be achieved by simply following the wizard prompts and instructions.

The uniquely powerful data loader differentiates WILFr from our competitors. WILFr users have the advantage of being able to extract data directly from multiple source systems, both front and back office, including 14 core banking systems, such as Aurius, Avaloq, Essence, Flexcube, Midas and T24 are already supported. As a relational data warehouse, WILFr consolidates the data to provide a central point of reference, and a single view across the whole business. Detailed and accurate business information can be compiled for regulatory, management and operational reporting through WILFr's front-end, or using other presentation products.

Our direct database to database load, eliminates the need for intermediate stages, thereby creating performance efficiencies and reducing operational risk during BAU, but additionally offering savings on change management and upgrade costs, leading to potentially quicker delivery times and reduced change risk. WILFr supports proprietary data types from external systems converting them into native SQL data types. As WILFr is 'aware' of any changes to the data load process, or underlying source systems, it can recompile itself to maintain the integrity of the WILFr database.

The data load process is multi-threaded for optimised performance and speed and is fully automated to provide daily, intra-day, full or partial loads.

WILFrv2.1 has been upgraded to be compatible with the .Net 4.6 framework which is the pre-installed version of the latest MS operating systems, which offers performance improvements, heightened security and easier integration with other products implementing newer technologies. We have also made multiple improvements to our regulatory reporting and our Logical Object reporting suite.

Following discussions and clarification from HMRC this patch includes improvements to the depth of data held in WILFr, which is used to help identify and classify potentially reportable individuals & organisations for the return, including previously reportable flags, entity classifications and customer onboarding date. The patch also contains various performance enhancements to improve the speed of XML file generation and the calculation of individual & organisational reportability.

After clarification from HMRC the latest patch has improvements to the 'Replacement Submission' to give the user more flexibility to choose which 'FI Action' and 'Account Actions' are used in the return. Other improvements include extra search criteria when searching for account holders to assist in identification of accounts.

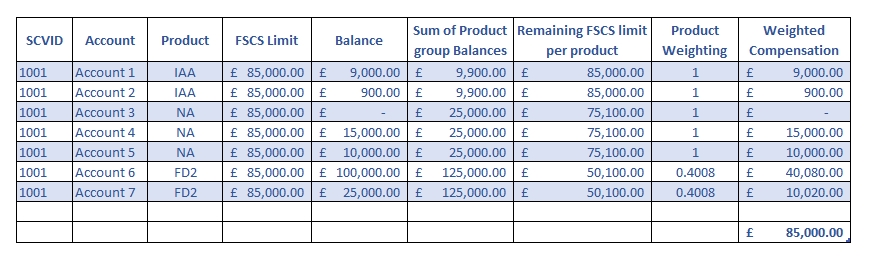

After confirmation from FSCS this patch has an update to display correctly penny apportioned negative balances in Table C but to continue showing negative balances as £0 in Table D of the extract. Clarification was also received from the PRA to include both positive and negative accrued interest when calculating account balances. The patch also includes other display improvements.

After discussions with FSCS we have amended our compensation logic to fully meet the 'Pari Passu' requirement from FSCS to split customers with multiple accounts by product hierarchy and then compensated equally amongst multiple accounts per product category. Further discussions with FSCS and relevant SCV analysts have led us to change our logic to deal with customers who have accounts split across the SCV and Exclusion files to treat their aggregate balances and compensation amounts separately. PGP encryption is also supported with the option to zip & password protect the extract files. Other small enhancements include fully integrating the FSCS data validations with the WILFr Exceptions Dashboard, extract analysis for currency breakdowns to include exchange rates, additional refinements to the data validations and other minor formatting changes.

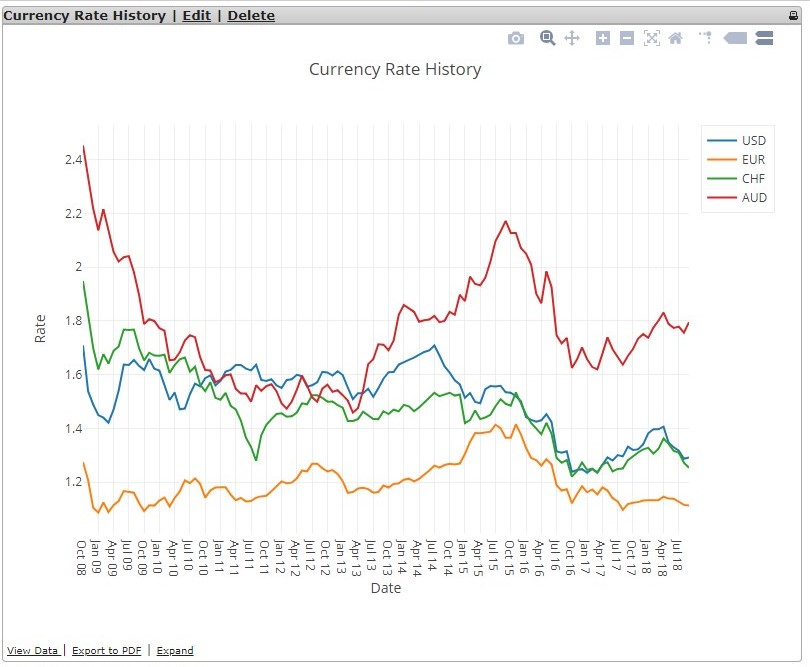

As part of our continual drive to improve WILFr we are incorporating an improved, modern charting framework that will enhance the presentation of data on the website. Since the new charting framework will sit alongside the existing framework, charts built using the previous framework will continue to be supported.

The new charting tools promise to offer a more dynamic and faster user experience. More than 30 chart types will be available, with in-browser features such as zoom, pan and hover, plus other dynamic features to allow users more meaningful interaction with their data. For advanced users there will be complete control over presentation through editing of the coded definition of the chart.