The EU Payment Accounts Directive (PAD) was adopted in July 2014. Its main aim is to help the EU internal market for payment accounts work well. It seeks to improve:

The provisions of the Payment Services Directive, 2014/92/EU, related to comparability of fees are aimed at putting consumers into a position to more easily shop around and change providers, possibly even on a cross-border basis.

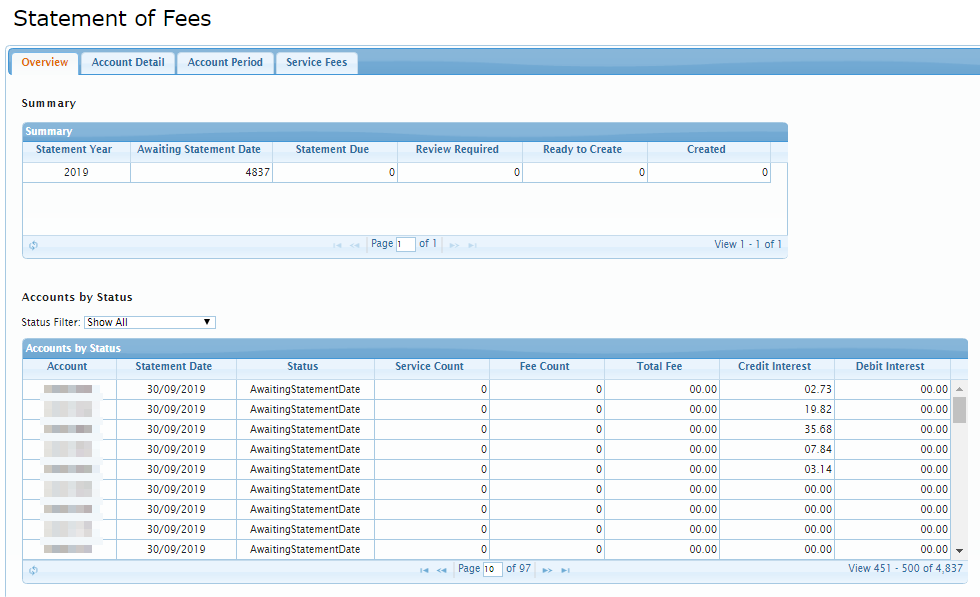

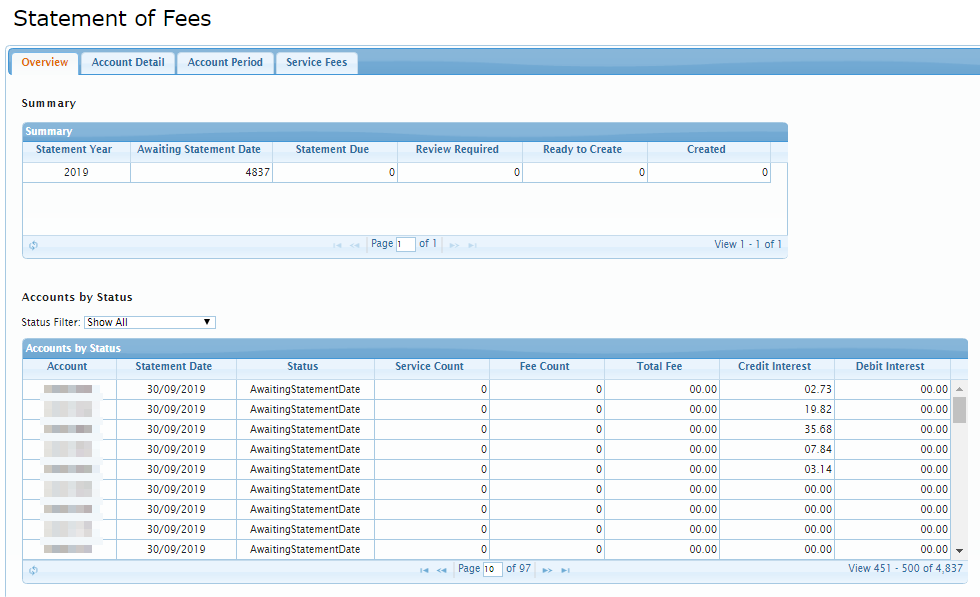

The directive requires EU payment service providers to provide customers with a statement of all fees incurred and information regarding interest rates for services linked to a payment account at least annually, free of charge. The communication sent to a customer needs to be sent out in the Statement of Fees (‘SoF’) template format defined by the EBA and follow the EBA’s regulatory technical standards (RTS) & Implementing technical standards (ITS) to meeting the SoF requirements and standardised presentation format.

The WILFr Statement of Fees component was developed to meet the needs of Banks to provide their customers with an annual statement detailing the fees that had been charged, as well as information regarding any interest rates linked to services on the customer’s account.

The WILFr Statement of Fees module provides the following:

By the end of 2020, every incoming single customer payment (MT 103 on FIN) will require a confirmation that the funds have been credited to the end beneficiary account. Confirmations are necessary to facilitate the smooth flow of money around the world. By providing these confirmations, Banks will be providing an improved customer service by offering transparency and certainty that the funds have reached their destination.

Confirmation is required within a maximum of two business days following the value date indicated on the MT 103. However, it is being encouraged that confirmation is provided as soon as possible. For those who have few payments per day, the Basic Tracker can be used which allows payments to be confirmed manually. Payments can be confirmed via the SWIFT interface using MT 199 messages, or via API calls for those who use the GPI connector.

If you would like to discuss the implications for your Bank, or how Fairmort could help to provide an automated solution, please contact Clive Bowles.

Over the past two months we have become aware of an increase in WILFr FSCS licensees being asked by the regulator to provide submissions. In light of this we suggest that this is a good time to test the FSCS file generation process and reconcile your returns to highlight any potential issues before a 24-hour notice is received. As always Fairmort will be available to assist with any support issue or to offer advice or consultancy services to ensure your Bank is in the best position to satisfy the regulator.

The current waiver by consent for the Continuity of Access (‘CoA’) rules expired on Sunday 1 December. Deposit-takers should consider whether they meet one of the three updated cases to be eligible for the new waiver and whether they wish to request the waiver by consent. This waiver by consent is available in relation to a firm if it meets criteria set out below. The waiver exempts a firm from the CoA rules (DPP 13.4-13.8 inclusive) and from the related CoA reporting requirements (DPP 15.2-15.4 inclusive and 15.7)

It is anticipated that the majority of WILFr Licensees will fall into Case 2. Should you require any advice or assistance please contact us.

To ensure our software is compliant with the latest regulations, Fairmort proactively checks the regulatory legislations for changes each month. These changes may have an impact on your business.

This edition provides further updates on the EBA’s v2.9 taxonomy changes that Fairmort reported in December 2018, and highlights proposed changes to Mortgage reporting requirements through the MLAR and PSD reports. Also see our regular PRA tracker.

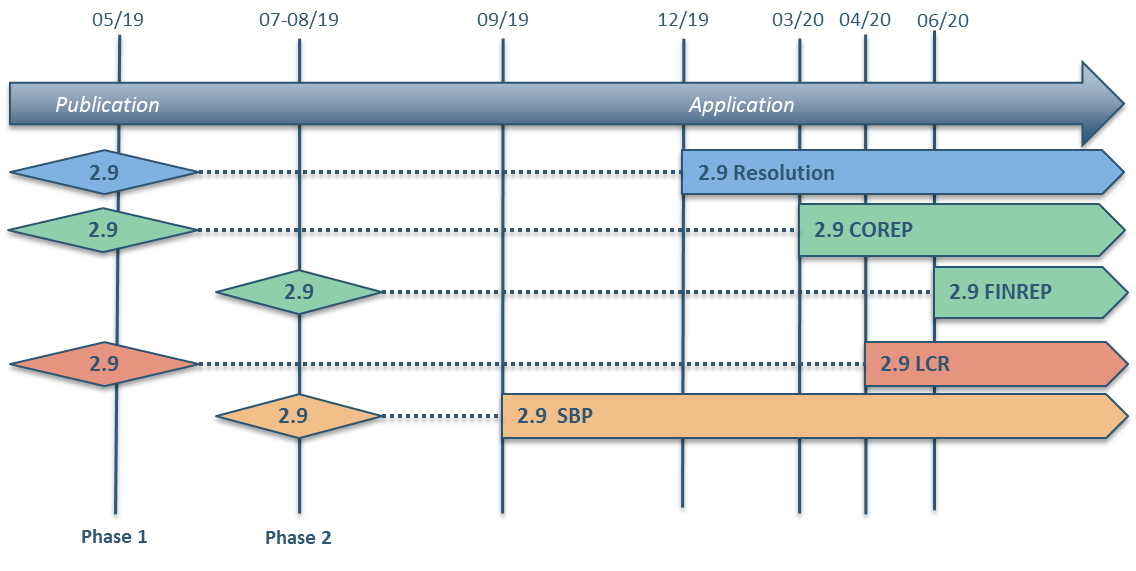

The EBA’s major updates to taxonomy in v2.9 are now partway through the multiple-stage release plan, which continues through to June 2020. Note that some dates have moved since our last Newsletter. The latest delivery schedule diagram is shown below:

Note also that a subsequent minor update has been announced as v2.9.1. We have prepared and released taxonomy updates to those clients that are affected, and we will continue to do so over the coming months, in line with the rollout schedule.

You can find full details of the EBA’s planned changes at the following link:https://eba.europa.eu/risk-analysis-and-data/reporting-frameworks/reporting-framework-2.9

The PRA has announced updates to the MLAR, and PSD001 and PSD007 reporting which would apply to regulated mortgage lenders and home finance administrators, which are to be implemented in a rollout schedule from October 2020 through to April 2021.

Full details can be found in the policy statement at https://www.bankofengland.co.uk/prudential-regulation/publication/2018/fca-and-pra-changes-to-mortgage-reporting-requirements

We frequently monitor PRA announcements and publications and log them in our PRA tracker.

| Date | Topic | Ref | Other Ref | Report | Comment | Link to Webpage | |

|---|---|---|---|---|---|---|---|

| 08 November 2019 | EBA | EBA publishes technical package on reporting framework 2.9.1 | The European Banking Authority (EBA) published today a new release of reporting framework 2.9.1, which includes the validation rules, the DPM data dictionary, and the XBRL taxonomy. This release fixes some modelling issues on COREP Liquidity and FINREP. | Click Here | |||

| 08 November 2019 | Statistical notice No. 518/11/2019 Form AS and Form FV update | ASFV | The Bank of England will be publishing an updated Form AS and Form FV taxonomy and associated validation rules that will make reporting more robust and fix a number of bugs identified within the original taxonomy. This release will not include any material changes to the data that are collected and will not feature any new fields. As a result of these improvements all validation rules will be changed from non-blocking to blocking reflecting that all rules must be passed before a submission will be accepted. It is anticipated that first reporting of the new taxonomy will be for Q1 2020 submissions with the reporting window for this period pushed back to accommodate a six month lead time from the final publication of the updated taxonomy. | Click Here | |||

| 08 November 2019 | BOE | Statistical notice No. 5 | Yellow Book | Publication of the Reporting Schedule 2020 | Click Here | ||

| 28 October 2019 | FCA | Change to Handbook MCOB 11.9 | MCOB 11.9 | PS19/27 | MCOB 11.9 Remortgaging with the same or a different lender with no additional borrowing. The FCA published final rules designed to remove barriers to consumers switching to a more affordable mortgage in PS19/27: Changes to mortgage responsible lending rules and guidance on 28 October 2019. Consumers who are looking to remortgage, but not borrow additional funds, can now make use of modified assessments based upon the cost of a new mortgage product, assuming certain eligibility requirements are met. | Click Here | |

| 17 October 2019 | PRA | Publishes CP27/19 | CP 27/19 | In this Consultation Paper (CP), the Prudential Regulation Authority (PRA) sets out proposals to update Supervisory Statement (SS) 24/15 ‘The PRA’s approach to supervising liquidity and funding risk’ (see Appendix) to reflect relevant updates to the Bank of England’s Market Operations Guide (Market Operations Guide) and to reiterate relevant expectations set out in SS9/17 ‘Recovery Planning’. This CP is relevant to PRA-authorised UK banks, building societies, and PRA-designated UK investment firms, referred to collectively as ‘firms’. | Click Here | ||

| 16 October 2019 | EBA | Consults on supervisory reporting changes related to CRR2 and Backstop Regulation (Framework 3.0) | The European Banking Authority (EBA) launched today a public consultation on revised Implementing Technical Standards (ITS) on supervisory reporting, which aim to keep the reporting requirements in line with changes in the regulatory framework and with the evolving needs for Supervisory Authorities' risk assessments. In particular, in 2019, there were two amendments to the CRR affecting supervisory reporting: The amending Regulation (EU) 2019/876 (‘CRR2'), which implements a number key measures such as liquidity, leverage and large exposures; The amending Regulation (EU) 2019/630 (‘Backstop Regulation'), which sets minimum loss coverage for future non-performing exposures (NPEs). | Click Here | |||

| 16 October 2019 | EBA | Public consultation on the new comprehensive Implementing Technical Standard (ITS) for financial institutions' public disclosure, designed to promote market discipline. | The amending regulation (EU) No 2019/876 (‘CRR2') | The European Banking Authority (EBA) launched today a public consultation on the new comprehensive Implementing Technical Standard (ITS) for financial institutions' public disclosure, designed to promote market discipline. This ambitious proposal seeks to optimise the EBA Pillar 3 policy framework by moving from a silo based approach, with different disclosure policy products, to an all-inclusive ITS. It also implements regulatory changes introduced by the CRR2 and aligns the disclosure framework with international standards. | Click Here | ||

| 10 January 2019 | PRA | Consultation Paper - Eligibility of financial collateral | CP 1/19 | In this Consultation Paper (CP), the Prudential Regulation Authority (PRA) sets out its proposed changes to Supervisory Statement (SS) 17/13 ‘Credit risk mitigation’ to clarify expectations regarding the eligibility of financial collateral as funded credit protection under Part Three, Title II, Chapter 4 (Credit risk mitigation) of the Capital Requirements Regulation (575/2013) (CRR). This CP is relevant to UK banks, building societies and PRA-designated UK investment firms that are subject to the CRR. | Click Here | ||

| 15 October 2019 | BoE | Discontinuation of form VP | VP | Discontinuation of form VP. The Bank is proposing to discontinue collection of Form VP, with the End-September 2019 reporting being the last. The discontinuation of this collection will mean that the Securitisation SPV and Covered Bond LLP lists will no longer be updated, but the current lists will continue to be accessible on the website. | Click Here | ||

| 14 October 2019 | PRA | Gabriel - news on replacing Gabriel | On 16 July 2019 the Financial Conduct Authority (FCA) published an update to firms announcing a new platform to improve the way data is collected from firms, which will include replacing Gabriel, and opened a survey for users of Gabriel. The FCA has now published an update on the three key areas of improvement that they will focus on following user feedback. These include: accessing Gabriel, viewing reporting schedules and submitting data. | ||||

| 11 October 2019 | PRA | PRA RULEBOOK: CRR FIRMS: LARGE EXPOSURES AMENDMENT INSTRUMENT 2019 - effective 01/01/2020 | Article 395(1) of the CRR, | On 1 July 2018, by a Decision of the Haut Conseil de stabilité financière and pursuant to Article 458(2) of Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment (“CRR”), France implemented a tightening of the large exposure limit provided for in Article 395(1) of the CRR, applicable to exposures to certain French counterparties (“the French measure”). E. On 1 February 2019, the European Systemic Risk Board issued Recommendation ESRB/2018/8, recommending reciprocation of the French measure by other member states of the European Union. F. On 17 July 2019, HM Treasury gave notice under Article 458(6) of the CRR of its decision under Article 458(5) of the CRR to recognise the French measure in the United Kingdom. | Click Here | ||

| 03 October 2019 | PRA | Published: a further update (Version 01.03) to the PRA110 liquidity metric monitor tool (PRA110 LMM tool) | PRA 110 | Published: a further update (Version 01.03) to the PRA110 liquidity metric monitor tool (PRA110 LMM tool) based on the current template, in response to feedback received on Version 01.02, published on Friday 30 August 2019. a new liquidity metric monitor tool (PRA110 LMM tool, Version 02.01) reflecting the changes to the PRA110 template effective from 1 January 2020, as set out in PS13/19 ‘Pillar 2 liquidity: Updates to the framework’. Version 7 of the PRA110 Q&A. For more information see the Regulatory reporting – banking sector Banks, building societies and investment firms webpage. | Click Here | ||

| 02 October 2019 | FCA | Overdraft Pricing and Competition Remedies | PS19/25 | This Policy Statement (PS19/25) sets out rules to make overdraft fees clearer and more transparent. | Click Here | ||

| 30 September 2019 | PRA | Consultancy paper - Asset Encumbrance | CP 24/19 | In this CP, the PRA sets out its proposed expectations of firms when managing the key prudential risks associated with asset encumbrance, specifically in the contexts of managing liquidity and funding risks, recovery planning, and resolution. The PRA’s proposed expectations relate both to firms’ internal monitoring and management of these risks, and to the information that firms are expected to provide to the PRA through their periodic regulatory submissions, eg Internal Liquidity Adequacy Assessment Process. | Click Here | ||

| 30 September 2019 | PRA | Published a joint Policy Statement (PS) with the Financial Conduct Authority (FCA), PS22/19 ‘FCA and PRA changes to mortgage reporting requirements’. This PS is relevant to: mortgage lenders; home finance administrators; and entities, which own mortgage books but which are not authorised to lend. | MLAR | Published a joint Policy Statement (PS) with the Financial Conduct Authority (FCA), PS22/19 ‘FCA and PRA changes to mortgage reporting requirements’. This PS is relevant to: mortgage lenders; home finance administrators; and entities, which own mortgage books but which are not authorised to lend. As part of PS22/19 the PRA has also published updated versions of the: Notes for completion of the Mortgage Lenders & Administrators Return (MLAR); MLAR form; and Updated SS34/15 ‘Guidelines to completing regulatory reports’, which includes a link to the notes for completion of the MLAR. The updated MLAR notes and form are available on the Regulatory reporting – Banking sector Banks, building societies and investment firms webpage. | Click Here | ||

| 30 September 2019 | PRA | This Prudential Regulation Authority (PRA) Policy Statement (PS) provides feedback to responses to Consultation Paper (CP) 13/19 ‘Occasional Consultation Paper’. It also includes the final rules, updated supervisory statements (SS), and relevant templates and LOG files. | PS 21/19 | Chapter 4 of CP13/19 – UK banks and UK designated investment firms with Capital Requirements Regulation (CRR) Internal Model Approach (IMA) permissions. | |||

| 27 September 2019 | PRA | Strengthening individual accountability: Resolution assessments and reporting amendments - PS20/19 | PS 20/19 | This Prudential Regulation Authority (PRA) Policy Statement (PS) provides feedback to responses to Consultation Paper (CP) 12/19 ‘Strengthening individual accountability: Resolution assessments and reporting amendments’. This PS also contains the PRA’s final policy in respect of amendments to: the prescribed responsibility (PR) for recovery plans and resolution packs contained in the Allocation of Responsibilities part of the PRA Rulebook (Appendix 1); Supervisory Statement (SS) 28/15 ‘Strengthening individual accountability in banking’ (Appendix 2); and the form ‘Senior Managers Regime: Statement of Responsibilities’ (SoR form) (Appendix 3). | |||

| 26 September 2019 | FCA | OVERDRAFTS (INFORMATION AND TOOLS) INSTRUMENT 2019 | This instrument comes into force on: (1) 2 October 2019 for Part 1 of the Annex; (2) 18 December 2019 for Part 2 of the Annex; and (3) 6 April 2020 for Part 3 of the Annex. | Click Here | |||

| 24 September 2019 | PRA | Published version 3.2.1 of the Bank of England Banking XBRL taxonomy as a corrective release. Version 3.2.0 has been withdrawn and must not be used for reporting. | Published version 3.2.1 of the Bank of England Banking XBRL taxonomy as a corrective release. Version 3.2.0 has been withdrawn and must not be used for reporting. Additionally, we published a public working draft (PWD) of version 3.3.0 of the Bank of England Banking XBRL taxonomy to support collection of Capital+ and ring-fencing reporting, alongside related technical artefacts. The taxonomy, data point model (DPM) dictionary, annotated templates and validation rules represent the requirements for PS16/19 ‘Regulatory reporting: European Banking Authority Taxonomy 2.9’. We invite feedback, particularly from firms and software vendors, on the PWD of the taxonomy and DPM artefacts by Monday 7 October 2019. We will aim to publish the updated Banking XBRL taxonomy by end January 2020. See the Taxonomy section of the Regulatory reporting – banks, building societies and investment firms page for more information. | ||||

| 18 September 2019 | PRA | Consultation paper - probablility of default | CP 21/19 | In this CP, PRA sets out its proposed approach to implementing the European Banking Authority’s (EBA) recent regulatory products relating to Probability of Default estimation, Loss Given Default estimation and the treatment of defaulted exposures in the Internal Ratings Based approach to credit risk.The proposals are relevant to UK banks, building societies and PRA-designated UK investment firms. | Click Here | ||

| 18 September 2019 | PRA | Published clarifications in respect of the guidance on reporting and definitions to the MREL reporting templates available in Appendix 2 of PS11/18 ‘Resolution planning: MREL reporting’. | PA 11/18 | MREL | On 7 June 2019, the European Union published a new Regulation (EU/2019/876) amending Regulation (EU/575/2013) and Regulation (EU/648/2012) (CRR II) in the Official Journal of the European Union. Following this, we published clarifications in respect of the guidance on reporting and definitions to the MREL reporting templates available in Appendix 2 of PS11/18 ‘Resolution planning: MREL reporting’. | Click Here | |

| 13 September 2019 | PRA | Continuity of Access rules. | The PRA published a new waiver by consent to waive the Continuity of Access requirements contained in the Depositor Protection Part of the PRA Rulebook. More information is available on the Authorisations – Waivers and modifications of rules page. aiver by consent: Continuity of Access rules 13 September 2019 | Click Here | |||

| 12 September 2019 | PRA | The PRA published updated Supervisory Statement SS34/15 Guidelines for completing regulatory reports | SS 34/15 | The PRA published Supervisory Statement SS34/15 Guidelines for completing regulatory reports on 12 September 2019. The statement sets out the PRA’s expectations for how firms should complete the data items and returns required under the Regulatory Reporting, Close Links and Change in Control sections of the PRA Rulebook. | Click Here | ||

| 12 September 2019 | PRA | Published PS17/19 ‘Supervising international banks: Revision of the Branch Return’, which is relevant to all existing and prospective PRA-supervised branches of deposit takers and PRA-designated investment firms which are not UK headquartered firms (‘international banks’, and includes: | PS 17/19 | Branch Return | We published PS17/19 ‘Supervising international banks: Revision of the Branch Return’, which is relevant to all existing and prospective PRA-supervised branches of deposit takers and PRA-designated investment firms which are not UK headquartered firms (‘international banks’, and includes: amendments to the Regulatory Reporting and Incoming Firms and Third Country Firms Parts of the PRA Rulebook (Appendix 1); reporting guidance included in updated Supervisory Statement (SS) 34/15 ‘Guidelines for completing regulatory reports’ (Appendix 2); and revised Branch Return template Appendix 3). Changes to the Branch Return template and the reporting guidance will take effect for the reporting of the H1 2020 Branch Return, ie for the six-month period ending Tuesday 30 June 2020 and firms will need to submit their first revised Branch Return by no later than Tuesday 11 August 2020. | Click Here | |

| 09 September 2019 | PRA | Published CP20/19 ‘Regulatory capital instruments: | CP 20/19 | Published CP20/19 ‘Regulatory capital instruments: update to Pre-Issuance Notification (PIN) requirements’ which sets out proposals for amendments to the Pre-Issuance Notification (PIN) regime applicable to PRA-authorised Capital Requirements Regulation (575/2013) (CRR) firms. This consultation closes on Monday 9 December 2019. | Click Here | ||

| 30 August 2019 | PRA | Published v3.2.0 of the Bank of England XBRL taxonomy. | The European Banking Authority (EBA) published today a new release of the reporting framework 2.9, which includes the validation rules, the DPM data dictionary and XBRL taxonomies. The update reflects the amendments to the Implementing Technical Standards (ITS) on supervisory reporting related to FINREP and those to the ITS on benchmarking of internal approaches, both published on 16 of July 2019. | Click Here | |||

| 21 August 2019 | EBA | EBA publishes phase 2 of its technical package on reporting framework 2.9 | The European Banking Authority (EBA) published today a new release of the reporting framework 2.9, which includes the validation rules, the DPM data dictionary and XBRL taxonomies. The update reflects the amendments to the Implementing Technical Standards (ITS) on supervisory reporting related to FINREP and those to the ITS on benchmarking of internal approaches, both published on 16 of July 2019. | Click Here | |||

| 14 August 2019 | EBA | EBA publishes clarifications to the fifth set of issues raised by its Working Group on APIs under PSD2 | PSD2 | The European Banking Authority (EBA) published today clarifications to a fifth set of issues that had been raised by participants of its Working Group (WG) on APIs under PSD2. The clarifications respond to issues raised on the measurement of response times of the dedicated interface, the machine-readability of the EBA register, reliance on eIDAS certificates and various issues related to the contingency measures, including the identification of third party providers through ‘guest books', the data that can be accessed and documentation. | Click Here | ||

| 08 August 2019 | EBA | The European Banking Authority (EBA) published today an opinion on the implementation of the Deposit Guarantee Schemes Directive (DGSD) in the EU. | The European Banking Authority (EBA) published today an opinion on the implementation of the Deposit Guarantee Schemes Directive (DGSD) in the EU. It proposes a number of changes aimed at strengthening depositor protection, enhancing financial stability and improving operational effectiveness. Two other opinions are forthcoming later in 2019. | Click Here | |||

| 07 August 2019 | PRA | Regulatory reporting: EBA Taxonomy 2.9 - PS16/19 | PS 16/19 | ImplementationThe changes to the PRA Rulebook for Capital + templates PRA 101, PRA 102 and PRA 103 will take effect on Sunday 1 March 2020. The changes to the PRA Rulebook and SS34/15 ‘Guidelines for completing regulatory reports’ for ring-fenced bank template RFB004, and the scope of FINREP reporting required from firms that are not currently required under the CRR to report FINREP, will take effect on Monday 1 June 2020. The policy set out in this PS has been designed in the context of the current UK and EU regulatory framework. The PRA has assessed that the policy will not be affected in the event that the UK leaves the EU with no implementation period in place. | Click Here | ||

| 29 July 2019 | PRA | UK withdrawal from the EU: Changes following extension of Article 50 | CP 18/19 | The UK’s withdrawal from the European Union (EU) requires changes to be made to UK legislation to ensure that it remains functional. The European Union (Withdrawal) Act 2018 (the Act) converts directly applicable EU law (eg EU regulations) into UK law and preserves domestic law that relates to EU membership, including domestic law that was introduced to implement EU directives. This body of law is referred to as ‘retained EU law’. The Act also provides Government ministers with powers to make changes to the law so that it continues to operate effectively after the UK’s withdrawal from the EU – these processes are referred to as ‘onshoring’ or ‘Nationalising the Acquis’ (NtA). The Government has delegated some of these powers to the Bank of England (Bank), as resolution authority and financial market infrastructure (FMI) competent authority, and the Prudential Regulation Authority (PRA). | Click Here | ||

| 26 July 2019 | EBA | EBA publishes clarifications to the fourth set of issues raised by its Working Group on APIs under PSD2 | PSD2 | The European Banking Authority (EBA) published today clarifications to a fourth set of issues that had been raised by participants of its Working Group (WG) on APIs under PSD2. The clarifications respond to issues raised on the confirmation of payment execution, biometrics and authentication on mobile apps, access to non-payment account information, stress testing, qualified eIDAS certificates for Account Servicing Payment Service Providers (ASPSPs), the 4 times per day access by Account Initiation Service Providers (AISPs), and the Sharing of payment account number with Payment Initiation Service Providers (PISPs). | Click Here | ||

| 23 July 2019 | EBA | EBA publishes its roadmap on IFRS 9 deliverables and launches IFRS 9 benchmarking exercise | IFRS 9 | The European Banking Authority (EBA) published today its IFRS 9 roadmap providing a comprehensive overview of planned monitoring activities on IFRS 9 implementation. The EBA also launched an IFRS 9 benchmarking exercise on a sample of institutions aimed at analysing the different modelling practices followed by institutions and how IFRS 9 implementation impacts the amount of expected credit losses in terms of own funds and regulatory ratios. | Click Here | ||

| 23 July 2019 | FCA | FCA launches consultation guiding firms on the fair treatment of vulnerable customers. | GC 19/3 | GC19/3: Guidance for firms on the fair treatment of vulnerable customers | Click Here | ||

| 23 July 2019 | PRA | Counterparty credit risk: Treatment of model limitations in banks’ internal models. | CP 17/19 | This consultation paper (CP) sets out the Prudential Regulation Authority’s (PRA) proposed changes to Supervisory Statement (SS) 12/13 ‘Counterparty Credit Risk’ to clarify expectations regarding the treatment of model limitations and assumptions under Part Three, Title II, Chapter 6 (counterparty credit risk) of the Capital Requirements Regulation (575/2013) (CRR). The CP is relevant to all firms to which CRD IV applies. Draft amendments to the SS, which add a new chapter (4A) are set out in the Appendix. | Click Here | ||

| 23 July 2019 | PRA | Credit risk mitigation: Eligibility of financial collateral | PS 14/19 | This Prudential Regulation Authority (PRA) Policy Statement (PS) provides feedback to responses to Consultation Paper (CP) 1/19 ‘Credit risk mitigation: Eligibility of financial collateral’. It contains the updated Supervisory Statement (SS) 17/13 ‘Credit risk mitigation’ (Appendix). | Click Here | ||

| 17 June 2019 | PRA | Pillar 2 liquidity: Updates to the framework | PS 13/19 | CP 6/19 | This Prudential Regulation Authority (PRA) Policy Statement (PS) provides feedback to responses to Consultation Paper (CP) 6/19 ‘Pillar 2 liquidity: Updates to the framework’. It also contains the PRA’s final policy | Click Here |

It is highly recommended that the FSCS v1.1 patch is applied as it compiles feedback from FSCS for reported submission issues, clarification of questions we have raised directly with FSCS, general bug fixes and extra functionality for the FSCS module. One of the main functionality changes in the release is that the logic for calculating the customer account level compensation now fully complies with the FSCS ‘Pari Passu’ split apportioned balance per product hierarchy after feedback and discussions with the FSCS directly.

Additional updates include extra data validations compiled from licensee feedback (telephone numbers, email addresses, name and country additional checks), removal of the FSCS template header, a new popup checklist which appears before generating a submission, the ability to generate PGP encrypted files and other minor visual updates to the FSCS module.

After a successful May 2019 Submission for all our licensees, we have internally reviewed our AEOI module and added some additional features to help users manage their data more efficiently, added some additional data validation checks from HMRC feedback post submissions and fixed some minor display bugs. Some of the additional features include, the ability to change account holder types through the module, a new hyperlink feature to quickly jump between the account / party maintenance screens for customers, performance improvements when loading customers and accounts, the ability to copy reportable jurisdictions from the previous year, reducing manual effort, the ability to edit payments and jurisdictions instead of deleting and re-adding them. The release includes additional widgets to help review previously reported individuals, organisations & controlling persons to be confident that the right people are being submitted in comparison to the previous year’s submission.