It has been 8 years since we first deployed WILF Reporting (WILFr) which was called BIRT in those days. WILFr was originally conceived as a solution to the reporting needs of Bankmaster customers who struggled to report against a complex, transaction based and non-SQL compliant core banking database. WILFr now extracts data from over 18 different core banking systems as well as numerous lending, CRM and accounting systems, providing banks and other financial institutions with a single data repository from which they can produce reports, extracts and feeds to other systems.

Although, originally used by UK institutions that were small in size, WILFr is now in use at banks of all sizes and located in many countries. In the last 4 years, Fairmort has built a number of standard reporting solutions for the UK such as Automatic Exchange of Information (AEOI), Financial Services Compensation Scheme (FSCS), Bank & Building Society Interest (BBSI), as well as the Prudential Regulation Authority (PRA) and the Financial Services Authority (FSA) reporting. European solutions are also catered for, such as Common Reporting (COREP) and the international Common Reporting Standard (CRS) tax reporting.

Over the last 12 months, our development focus has been on providing standard 'out-of-the-box' reports that cover the full requirements of the financial sector from profit and loss and balance sheet reporting to deposit, loan and customer service dashboards that provide a holistic view of an organisation's performance. Although delivered as standard reports, they can be customised to meet any differences in approach. Maintenance of new data sources and data fields has been made more straightforward for those staff administrating the system by moving its WILFr front-end application.

We are now working on several solutions that provide banks with the means to phase out the use of spreadsheets for day-to-day data management and reporting, by moving these activities to the WILFr data repository. In some cases, this involves additional data feeds being built to replace manual spreadsheet-based processes, in others it involves one-off data migrations and the maintenance of spreadsheet data in WILFr with the appropriate audit trails and access controls. We see this trend continuing and gathering pace as financial institutions seek to put in place a more robust reporting processes and remove some of the inherent risks in the current manual processing (human error, key-man risk etc). While we provide our own regulatory reporting suite which is particularly attractive to new entrants or those seeking to replace their existing systems, we are increasingly being asked to provide automated feeds to third party regulatory reporting systems due to our experience in the underlying core systems and our technical expertise to provide data in the required formats.

Our pragmatic approach of providing solutions and a platform for in-house reporting using tools such as SQL Server Reporting Services (SSRS), PowerBI etc, and the willingness to build standard extracts for competing regulatory providers delivers financial institutions with a solid platform to manage their data and reporting requirements.

Fairmort looks forward to working with its customers, suppliers and partners in the New Year and would like to wish all a very Merry Christmas and best wishes for the year ahead.

To ensure you are kept fully informed of all the WILFr features available to you view our WILFr Product Feature's handout.

To ensure our software is compliant with the latest regulations we proactively research regulatory changes monthly. These changes may have an impact on your business.

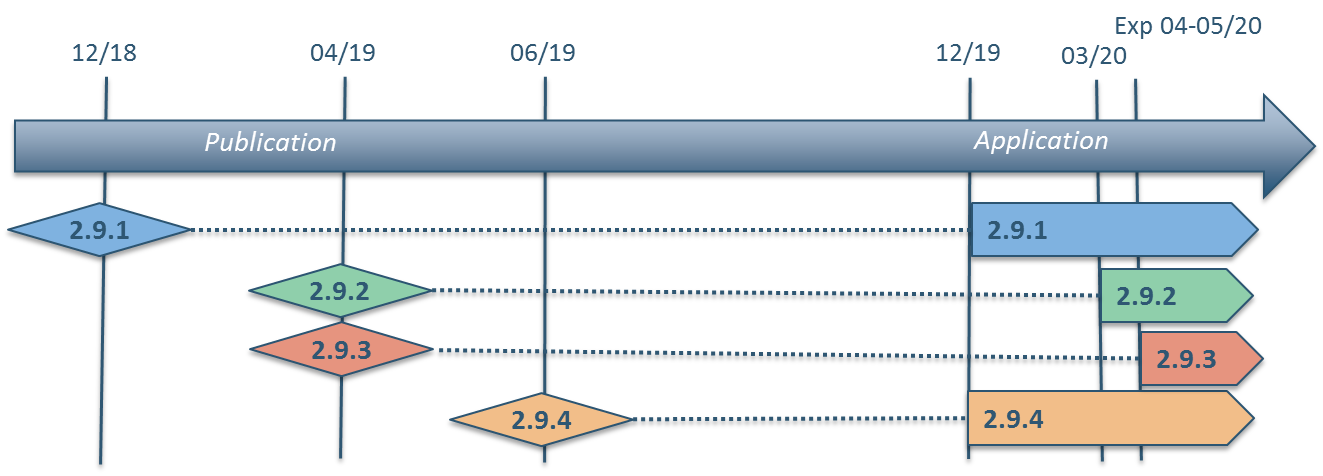

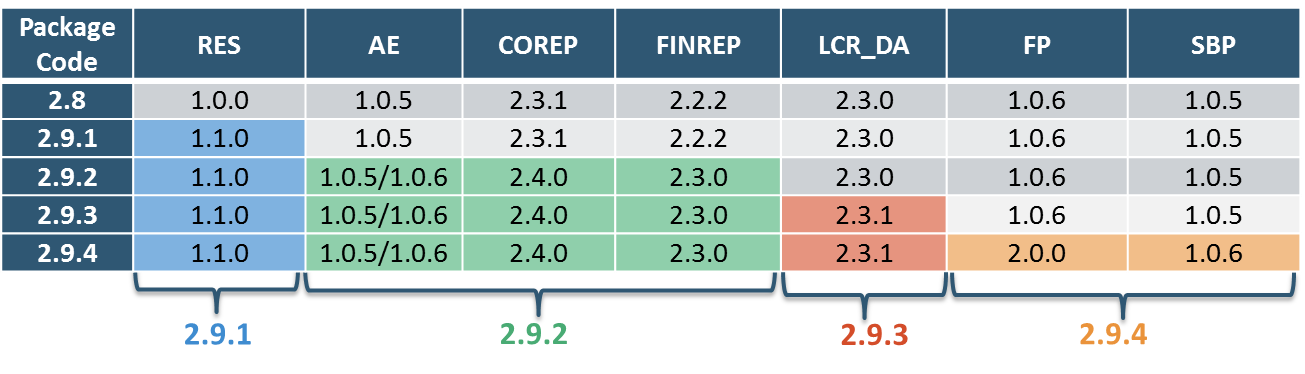

The European Banking Authority (EBA) has release plans for major updates to taxonomy in v2.9. Release 2.9 will be rolled out as 4 packages over 2 years.

The following table gives details of the release schedule:

Full details can be found on the EBA's website, found here.

The PRA has published a helpful Q&A factsheet in the run-up to the introduction of PRA110, which will be effective from 1st July 2019. The factsheet can be found here.

| Date | Topic | Ref | Report | Comment | Link to webpage | |

|---|---|---|---|---|---|---|

| 15th November 2018 | PRA | Securitisation: The new EU framework and Significant Risk Transfer | PS 29/18 | The date of application for the new securitisation legislative framework is Tuesday 1 January 2019. SS10/18 'Securitisation: General requirements and capital framework' and amendments to SS31/15 are effective from Tuesday 1 January 2019. The updated policies amending SS9/13 apply immediately after the publication of this PS to all PRA authorised CRD IV firms. | Click Here | |

| 14th November 2018 | PRA | Policy Statement 28/18 'UK leverage ratio: Applying the framework to systemic ring-fenced bodies and reflecting the systemic risk buffer' which includes updated policy, and materials. | Systemic risk buffer institutions | FSA083 | We published Policy Statement 28/18 'UK leverage ratio: Applying the framework to systemic ring-fenced bodies and reflecting the systemic risk buffer' which includes updated policy, and materials. For regulatory reporting this includes updated versions of the FSA083 data item and instructions that will take effect from 1 January 2019. | Click Here |

| 9th November 2018 | PRA | Publishes version 2 of the PRA110 Q&As | Q&A | PRA110 | PRA published version 2 of the PRA110 Q&As which has been updated to include responses on questions related to: technical implementation; the LCR weights; and memorandum items. This supersedes the version previously published on 28 September 2018. The Q&As are in response to a number of additional questions from firms regarding the template and reporting instructions. For more information see the Interim reporting of PRA110 section. | Click Here |

| 31st October 2018 | PRA | Publishes Ring-fencing: Summary of regulatory reporting requirements pack. | Ring-fencing | We published the 'Ring-fencing: Summary of regulatory reporting requirements' pack which summarises the new regulatory reporting, and reporting system requirements in relation to ring-fencing. The pack is aimed at UK banking groups in scope of structural reform requirements that will be required to submit ring-fencing regulatory returns from 1 January 2019. See the 31 October update on the Structural reform webpage. | Click Here | |

| 30th October 2018 | EBA | Draft consultation on data point model 2.9 | Data point model | The EBA published for consultation its draft data point model 2.9 on 30 October 2018. This concerns data requirements for supervisory reporting changes arising from the EBA's reporting framework 2.9 revision. This follows on from its related August 2018 consultation on changes to COREP and FINREP reporting. The consultation closes on 7 December 2018. | Click Here | |

| 25th October 2018 | BOE | Consultation papers on Brexit - no deal | Data point model | The BoE provided further details on its plans to have its regulatory framework in place should the UK leave the EU in March 2019 without a deal. The BoE/PRA published a set of consultation papers on 25 October 2018 setting out its proposed approach to on-shoring EU regulation and changes to existing BoE rules as a result of Brexit. | Click Here | |

| 15th October 2018 | FCA | Publishes feedback on Digital Regulatory Reporting | FS18/2 | The FCA published feedback statement FS18/2: Digital Regulatory Reporting (DRR), which summarises feedback on a proof of concept that would unlock smarter regulatory reporting, on 17 October 2018. The FCA received a positive response from the financial services industry. It's currently running a pilot to assess the technologies used to develop a DRR prototype, and intends to publish the findings in Q1 2019. | Click Here | |

| 12th October 2018 | PRA | Consultation paper Liquidity reporting | CP 22/18 | FSA047 FSA048 |

PRA publishes Consultation Paper (CP) 22/18 'Liquidity reporting: FSA047 and FSA048'. This CP is relevant to banks, building societies, and PRA-designated investment firms. This consultation closes on Monday 12 November 2018. | Click Here |

| 11th October 2018 | EC | New anti money laundering directive. | The EC adopted a new anti money laundering directive on 11 October 2018. The directive will impose minimum sanctions for criminal offences relating to money laundering, enable legal entities to be held liable for certain money laundering activities and remove barriers to cross-border judicial and police cooperation. The EC has given Member States up to 24 months to transpose the directive into national law. | Click Here | ||

| 10th October 2018 | FCA | Consultation paper Brexit & BTS | Brexit: proposed changes to the Handbook and Binding Technical Standards - first consultation | Click Here | ||

| 1st October 2018 | PRA | Updated Pillar 2 reporting comes into effect | Pillar 2 | PRA111 FSA071 to FSA082 |

Brexit: proposed changes to the Handbook and Binding Technical Standards - first consultation | Click Here |

| 28th September 2018 | PRA | Publishes Q&A on template and reporting instructions | Q&A | PRA110 | Following the publication of the final PRA110 template and associated reporting instructions in Policy Statement (PS) 2/18 'Pillar 2 liquidity', we have received a number of additional questions from firms regarding the template and reporting instructions. We have decided to publish answers to these questions ('Q&As') periodically, where questions received highlight a need to clarify the reporting instructions or rules. This document is version 1 of the PRA110 Q&As and covers responses on questions related to monetisation rows. In addition, having considered feedback from firms, we have reviewed the currency reporting basis for the interim reporting period: firms should only submit on an all-currency basis and for US Dollars (USD), where USD is a material currency. | Click Here |

| 19th September 2018 | EBA | Report on guidelines for IRRBB (Banking Book) published | IRRBB | The European Banking Authority (EBA) published its final report on Guidelines on the management of interest rate risk arising from non-trading ('banking') book activities (IRRBB) - one of the Pillar 2 risks specified in Capital Requirements Directive IV (CRD IV). The Guidelines will apply to firms from Sunday 30 June 2019. If firms have concerns about their ability to comply by the 2019 deadline, they should get in touch with their usual supervisory contacts. The Guidelines do not affect PRA published policy and reporting requirements on IRRBB, as set out in PRA Rules, SS, and Statements of Policy, which continue to apply. The Guidelines form part of a wider set of updated guidance by the EBA on the Pillar 2 framework, as published in the EBA's final guidance to strengthen the Pillar 2 framework. | Click Here | |

| 12th September 2018 | PRA | PRA published Consultation Paper (CP) 19/18 'Regulatory Reporting: EBA Taxonomy 2.9'. | CP 19/18 | We published Consultation Paper (CP) 19/18 'Regulatory Reporting: EBA Taxonomy 2.9'. This CP sets out proposals to update certain PRA reporting requirements to reflect relevant proposals made by the European Banking Authority (EBA) in its open consultations on changes to the Implementing Technical Standards on Supervisory Reporting. This consultation closes on Wednesday 12 December 2018. The PRA invites feedback on the proposals set out in this consultation. Please address any comments or enquiries to CP19_18@bankofengland.co.uk. | Click Here | |

| 31st August 2018 | PRA | Updated: RA Supervisory Statement (SS)19/13 | SS 19/18 | PRA Supervisory Statement (SS)19/13 'Resolution Planning' sets out the resolution planning information that firms are expected to provide to the PRA in accordance with the PRA's Resolution Pack rule in the PRA Rulebook. | Click Here | |

| 31st August 2018 | PRA | To assist firms with their submission of PRA110, PRA published a taxonomy release note alongside v3.1.1 of the XBRL taxonomy, data point model (DPM) and taxonomy validations | PRA 110 | Transition to v2.7 and v2.8 of EBA FINREP taxonomy In order to assist firms' planning for their upcoming regulatory reporting requirements, we have produced a graphic explaining when firms should transition to using v2.7 and v2.8 of the EBA's reporting taxonomy for FINREP (see 'EBA regulatory reporting: FINREP reporting taxonomy implications' below). | Click Here | |

| 31st August 2018 | PRA | Resolution planning - updated following EBA's final draft ITS on BRRD | MREL | The ITS set minimum data requirements for firms on resolution planning and will require firms to report using new templates from 31 May 2019. But the RTS allow resolution authorities to set alternative requirements for firms that qualify for simplified obligations. The BoE expects all UK banks and investment firms with resolution strategies not involving bail-in or partial transfer to have simplified obligations for resolution planning. In light of this, the PRA indicates that firms subject to simplified obligations should continue to follow its expectations set out in SS19/13 for Phase 1 resolution planning data submissions. And they need not make any additional ITS-related submissions unless the BoE informs them otherwise. | Click Here | |

| 28th August 2018 | EBA | Updating COREP and FINREP reporting | Consultation | The EBA published three consultationpapers: Draft ITS amending ITS (EU) 2016/322 with regard to LCR for liquidity reporting, Draft ITS amending ITS (EU) 680/2014 with regard to COREP securitisations and Draft ITS amending ITS (EU) 680/2014 with regard to FINREP on 28 August 2018. This is part of the EBA's preparations for the next supervisory reporting framework release - version 2.9. The EBA is structuring reporting framework 2.9 with different modules which it plans to publish and apply from different dates. |

The banking community is facing the challenge of an increasing pace of legislative change and the complexity it brings with it, at the same time as facing very dynamic market conditions driven by innovative technology.

We have therefore focussed our expertise in data management to create a versatile and cost-effective long-term solution to meet these challenges, called 'Logical Object Reporting'.

View our Logical Object Product Feature's handout to see how we can transform your reporting requirements.